Types of cryptocurrency

Hot storage wallets are generally considered less secure than cold storage wallets, and some Exodus users may eventually want to upgrade to cold storage. The good news: Exodus is fully compatible with Trezor’s One and Model T hardware.< https://trabajoenelextranjero.org/ /p>

Otherwise, fraudsters may pose as legitimate virtual currency traders or set up bogus exchanges to trick people into giving them money. Another crypto scam involves fraudulent sales pitches for individual retirement accounts in cryptocurrencies. Then there is straightforward cryptocurrency hacking, where criminals break into the digital wallets where people store their virtual currency to steal it.

Cold storage wallets are physical storage units that are kept offline and can only be accessed using a dongle — a physical USB that has to be plugged into your computer. They are generally thought of to be more secure than hot wallets because they’re not connected to the internet, but hot wallets are typically more easily accessible for making trades. Hot wallets include:

Before you invest, learn about cryptocurrency exchanges. It’s estimated that there are over 500 exchanges to choose from. Do your research, read reviews, and talk with more experienced investors before moving forward.

Как говорится, не мой ключ — не моя криптовалюта. Blockchain.com Private Key Wallet — это самые популярные кошельки для самостоятельного хранения криптовалюты. Мы облегчаем жизнь людям, готовым контролировать свои закрытые ключи с помощью секретной фразы для восстановления закрытых ключей.

Cryptocurrency news today

Hybrid mining gets 50% more paramining when the following conditions are met: 1. Network administration (forging). 2. Balance no more than 110,000 pzm. 3. Create 1 block at least once every 100,000 block heights.

The upcoming US presidential election is pivotal for the cryptocurrency sector, potentially influencing global crypto regulation and market dynamics. Industry experts in India and beyond are closely monitoring its outcome.

Hybrid mining gets 50% more paramining when the following conditions are met: 1. Network administration (forging). 2. Balance no more than 110,000 pzm. 3. Create 1 block at least once every 100,000 block heights.

The upcoming US presidential election is pivotal for the cryptocurrency sector, potentially influencing global crypto regulation and market dynamics. Industry experts in India and beyond are closely monitoring its outcome.

The commission is from 0.5% to 10 Pzm per transaction. The commission is calculated from the transaction initiator. If there are not enough coins, the system itself will offer the maximum number of coins to send.

Ethereum, как ведущая блокчейн-платформа, предлагает несколько преимуществ и недостатков, которые особенно актуальны в сегодняшнем новостном ландшафте. С положительной стороны, надежная функциональность смарт-контрактов Ethereum позволяет децентрализованным приложениям (dApps) процветать, способствуя инновациям в различных секторах, таких как финансы, игры и управление цепочками поставок. Кроме того, недавний переход на Ethereum 2.0 направлен на повышение масштабируемости и снижение потребления энергии, решая экологические проблемы, связанные с майнингом криптовалют. Однако проблемы остаются, включая высокие транзакционные сборы в часы пикового использования и продолжающийся контроль со стороны регулирующих органов, что может создать неопределенность как для инвесторов, так и для разработчиков. Кроме того, сложность его технологии может отпугнуть новых пользователей от взаимодействия с платформой. В целом, хотя Ethereum представляет значительные возможности для роста и развития, он также сталкивается с препятствиями, которые могут повлиять на его принятие и стабильность. **Краткий ответ:** У Ethereum есть такие преимущества, как надежные смарт-контракты и улучшенная масштабируемость с Ethereum 2.0, но он также сталкивается с такими недостатками, как высокие комиссии за транзакции и контроль со стороны регулирующих органов, что влияет на его общее принятие и пользовательский опыт.

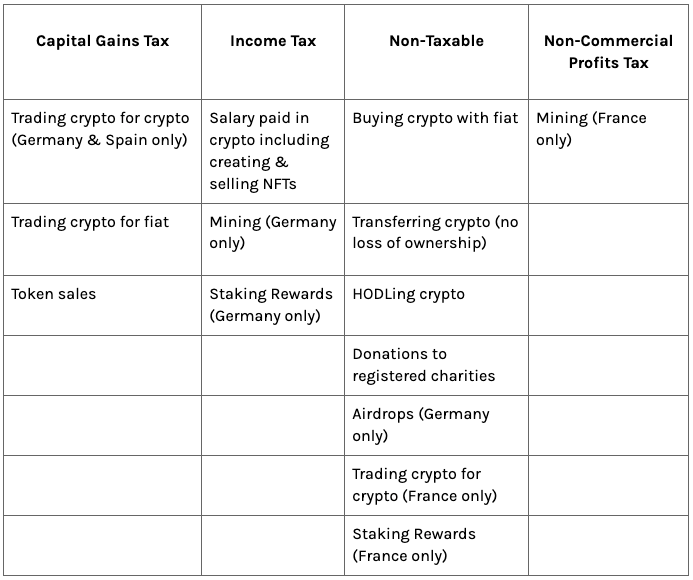

Cryptocurrency capital gains tax

Las administraciones de aduanas ven surgir nuevos retos a medida que aumenta el volumen del comercio internacional, aparece nueva tecnología y cambian los modelo de negocio. Este libro analiza los cambios y desafíos que enfrentan las administraciones de aduanas y propone formas de abordarlos. Describe los problemas que las autoridades deben tener en cuenta a la hora de elaborar su propia hoja de ruta para la modernización de las aduanas.

CoinTracker is a cryptocurrency portfolio tracker & tax calculator. It seamlessly integrates your existing cryptocurrency exchanges and wallets. CoinTracker is the most trusted place to monitor your cryptocurrency portfolio and calculate your cryptocurrency taxes.Easily track your portfolio in one place, view your return on investment, your unified transaction history, wallet balances, and much more. CoinTracker supports over 100 exchanges and wallets, and over 2,500 cryptocurrencies.CRYPTO TAXES MADE EASYCoinTracker calculates your cost basis and capital gains. Save hours of work with one of our tax plans, or download your transaction history for free.SECURE, AUTOMATIC SYNCINGCoinTracker synchronizes balances, transactions, and ERC20 tokens from your local wallets and exchange accounts. We have read-only access to your accounts, so rest assured your funds are safe.TRACK PERFORMANCEGet a clear picture of your crypto investments, including the current portfolio, your return on investment over time, and more.TRACK EVERY TRANSACTIONVisualize how your cryptocurrency moves between wallets and exchanges and see every transaction in one place.SUPPORTED CRYPTO WALLETS• Bitcoin (BTC)• Ripple (XRP)• Ethereum (ETH) including ERC20 transactions• Stellar (XLM)• Litecoin (LTC)• Cardano (ADA)• DASH (DASH)• NEO (NEO)• Dogecoin (DOGE)• and more!SUPPORTED EXCHANGES• Bibox• Binance• Bitfinex• BitMEX• Bittrex• BTC Markets• CEX.IO• Coinbase• Coinbase Pro• CoinSpot• Cryptopia• Gate.io• Gemini• HitBTC• Huobi• Kraken• Kucoin• Liqui• Poloniex• QuadrigaCX• and more!WORDS FROM OUR USERSI have been so frustrated with all the worthless crypto portfolio tracking junk apps. I have tried them all, I mean all of them … like 23. I just wanted to say thank you for this app. It’s perfect in every way and now I can sleep. You got a loyal customer for life. — P.V.Really, you’re receptive to changing based on feedback which portends good things for your venture. The Toyota ‘kaizen’ production system in action! — B.P.I bought your product, cointracking.info and bitcoin.tax and you guys were easily the best — H.B.Really awesome product! — D.G.I’ve switched over completely from Blockfolio and really loving the product. — S.B.Thank you for the awesome service! Will definitely be recommending to others. — J.W.I‘ve just recommended your site to a number of people in my bitcoin groups. All avid Coin Stats users but Coin Stats doesn’t track as well as your software does so hoping they may use yours instead. — H.T.Thank you for a great service. This is exactly what I was looking for, and it even has a few features that I didn’t know I needed before I actually had them. — D.F.So much better than Blockfolio. — E.R.the most promising — J.G.

Koinly is a tax solution for cryptocurrency investors and accountants. Anyone who owns multiple exchange accounts or wallets knows the pains when it comes to declaring taxes. Koinly was built to solve this very problem – by integrating with all major blockchains and exchanges such as Coinbase, Binance, Bittrex and CEX.io, Koinly reduces crypto tax reporting to a few minutes of work. Simply connect your exchange accounts / public addresses and let Koinly figure out your capital gains. Your final tax report is presented in a format that is accepted by your tax agency, making it easy to print & file. Alternatively, import our report into a tax filing software like TurboTax, TaxACT or Xero. We currently support 100+ countries, including the USA, UK, Canada, Australia, Sweden, Norway, Ireland and many more – see our website for the full list.

Las administraciones de aduanas ven surgir nuevos retos a medida que aumenta el volumen del comercio internacional, aparece nueva tecnología y cambian los modelo de negocio. Este libro analiza los cambios y desafíos que enfrentan las administraciones de aduanas y propone formas de abordarlos. Describe los problemas que las autoridades deben tener en cuenta a la hora de elaborar su propia hoja de ruta para la modernización de las aduanas.

CoinTracker is a cryptocurrency portfolio tracker & tax calculator. It seamlessly integrates your existing cryptocurrency exchanges and wallets. CoinTracker is the most trusted place to monitor your cryptocurrency portfolio and calculate your cryptocurrency taxes.Easily track your portfolio in one place, view your return on investment, your unified transaction history, wallet balances, and much more. CoinTracker supports over 100 exchanges and wallets, and over 2,500 cryptocurrencies.CRYPTO TAXES MADE EASYCoinTracker calculates your cost basis and capital gains. Save hours of work with one of our tax plans, or download your transaction history for free.SECURE, AUTOMATIC SYNCINGCoinTracker synchronizes balances, transactions, and ERC20 tokens from your local wallets and exchange accounts. We have read-only access to your accounts, so rest assured your funds are safe.TRACK PERFORMANCEGet a clear picture of your crypto investments, including the current portfolio, your return on investment over time, and more.TRACK EVERY TRANSACTIONVisualize how your cryptocurrency moves between wallets and exchanges and see every transaction in one place.SUPPORTED CRYPTO WALLETS• Bitcoin (BTC)• Ripple (XRP)• Ethereum (ETH) including ERC20 transactions• Stellar (XLM)• Litecoin (LTC)• Cardano (ADA)• DASH (DASH)• NEO (NEO)• Dogecoin (DOGE)• and more!SUPPORTED EXCHANGES• Bibox• Binance• Bitfinex• BitMEX• Bittrex• BTC Markets• CEX.IO• Coinbase• Coinbase Pro• CoinSpot• Cryptopia• Gate.io• Gemini• HitBTC• Huobi• Kraken• Kucoin• Liqui• Poloniex• QuadrigaCX• and more!WORDS FROM OUR USERSI have been so frustrated with all the worthless crypto portfolio tracking junk apps. I have tried them all, I mean all of them … like 23. I just wanted to say thank you for this app. It’s perfect in every way and now I can sleep. You got a loyal customer for life. — P.V.Really, you’re receptive to changing based on feedback which portends good things for your venture. The Toyota ‘kaizen’ production system in action! — B.P.I bought your product, cointracking.info and bitcoin.tax and you guys were easily the best — H.B.Really awesome product! — D.G.I’ve switched over completely from Blockfolio and really loving the product. — S.B.Thank you for the awesome service! Will definitely be recommending to others. — J.W.I‘ve just recommended your site to a number of people in my bitcoin groups. All avid Coin Stats users but Coin Stats doesn’t track as well as your software does so hoping they may use yours instead. — H.T.Thank you for a great service. This is exactly what I was looking for, and it even has a few features that I didn’t know I needed before I actually had them. — D.F.So much better than Blockfolio. — E.R.the most promising — J.G.

Koinly is a tax solution for cryptocurrency investors and accountants. Anyone who owns multiple exchange accounts or wallets knows the pains when it comes to declaring taxes. Koinly was built to solve this very problem – by integrating with all major blockchains and exchanges such as Coinbase, Binance, Bittrex and CEX.io, Koinly reduces crypto tax reporting to a few minutes of work. Simply connect your exchange accounts / public addresses and let Koinly figure out your capital gains. Your final tax report is presented in a format that is accepted by your tax agency, making it easy to print & file. Alternatively, import our report into a tax filing software like TurboTax, TaxACT or Xero. We currently support 100+ countries, including the USA, UK, Canada, Australia, Sweden, Norway, Ireland and many more – see our website for the full list.