Cryptocurrency

Ripple Custody is the industry standard for institutional-grade digital asset infrastructure. With support for XRPL, XRP and other blockchains and tokens, financial institutions can tap into new markets and access the entire digital asset ecosystem

In 2017, the company transferred 55 billion of its 80 billion XRP tokens into an escrow account from which it could sell a maximum of 1 billion tokens per month on the secondary market. https://mayfieldpalace.com/ Ripple did that to improve the transparency and predictability of XRP sales. XRP held in escrow are “undistributed” whereas the rest (including XRP held by Ripple in wallets) is distributed (i.e. circulating supply).

As a ‘payment currency’, XRP facilitates the exchange of a wide variety of digital and physical currencies on the XRPL. As per the project, among XRP’s key advantages are its speed. Transactions on the XRPL can be processed in just a few seconds. In addition, XRP claims to offer lower transaction fees compared to traditional financial systems. This is because the XRPL operates on a decentralized system, which eliminates the need for intermediaries like banks or payment processors.

XRP is the native digital asset on the XRP Ledger (XRPL) blockchain, built originally for payments. XRP primarily facilitates transactions on the network and bridges currencies in the XRP Ledger’s native DEX.

Ripple placed 55 billion XRP into a cryptographically-secured escrow account. By securing this XRP, people can mathematically verify the maximum supply of Ripple’s XRP that can enter the market.TOTAL XRP HELD BY RIPPLE 4,688,101,793TOTAL XRP DISTRIBUTED 55,999,283,950*TOTAL XRP PLACED IN ESCROW 39,300,000,005* As of July 21, 2024.

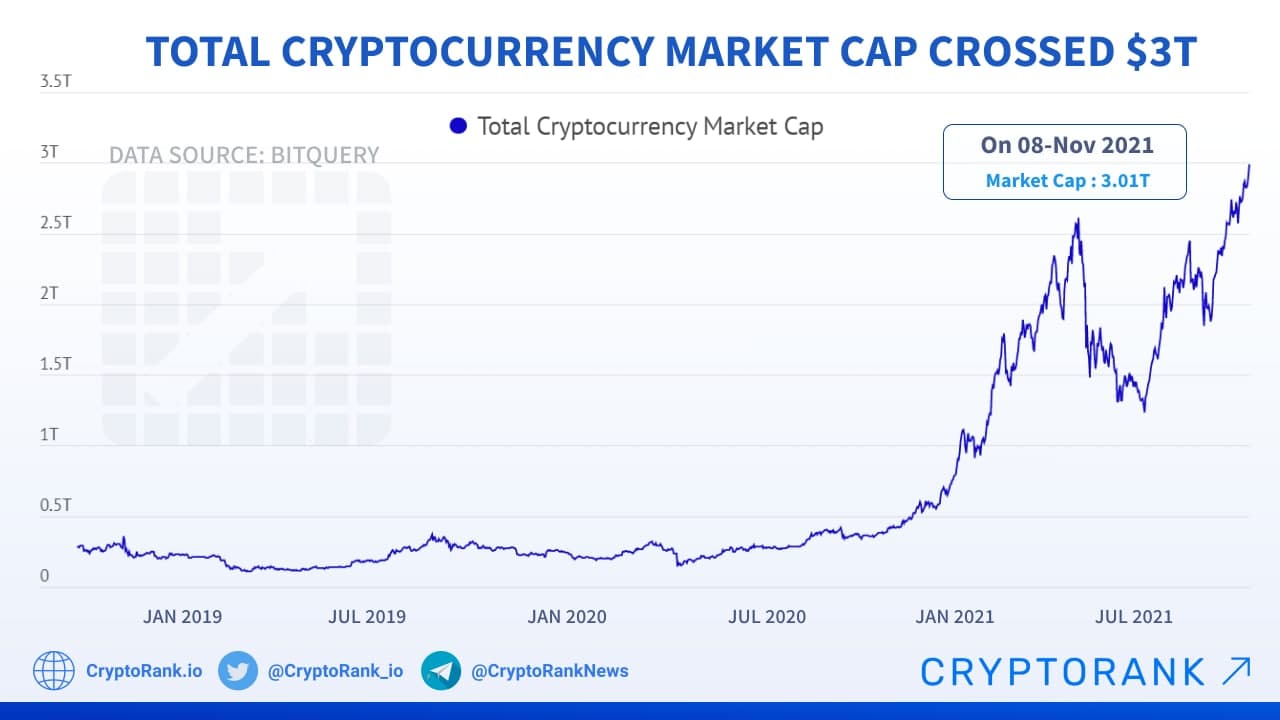

Cryptocurrency market cap

Bitcoin has not been premined, meaning that no coins have been mined and/or distributed between the founders before it became available to the public. However, during the first few years of BTC’s existence, the competition between miners was relatively low, allowing the earliest network participants to accumulate significant amounts of coins via regular mining: Satoshi Nakamoto alone is believed to own over a million Bitcoin.

Bitcoin’s source code repository on GitHub lists more than 750 contributors, with some of the key ones being Wladimir J. van der Laan, Marco Falke, Pieter Wuille, Gavin Andresen, Jonas Schnelli and others.

Play-to-earn (P2E) games, also known as GameFi, has emerged as an extremely popular category in the crypto space. It combines non-fungible tokens (NFT), in-game crypto tokens, decentralized finance (DeFi) elements and sometimes even metaverse applications. Players have an opportunity to generate revenue by giving their time (and sometimes capital) and playing these games.

Bitcoin has not been premined, meaning that no coins have been mined and/or distributed between the founders before it became available to the public. However, during the first few years of BTC’s existence, the competition between miners was relatively low, allowing the earliest network participants to accumulate significant amounts of coins via regular mining: Satoshi Nakamoto alone is believed to own over a million Bitcoin.

Bitcoin’s source code repository on GitHub lists more than 750 contributors, with some of the key ones being Wladimir J. van der Laan, Marco Falke, Pieter Wuille, Gavin Andresen, Jonas Schnelli and others.

Cryptocurrency trading platform

The trouble is that decentralized exchanges are much less user friendly, not only from an interface standpoint but also in terms of currency conversion. Decentralized exchanges, for instance, don’t always allow users to deposit dollars and exchange them for crypto. This means you either have to already own crypto or use a centralized exchange to get crypto that you then use on a DEX.

This exchange offers two trading platforms: Kraken and Kraken Pro. The basic Kraken platform with “Instant Buy” doesn’t offer the cheapest fees, although advanced users can get volume discounts and lower their costs by trading on Kraken Pro.

Just like when working with different brokers for trading stocks, fees can vary from crypto exchange to crypto exchange. If you want to find the exchange with the lowest fees overall, you’ll want to research trading fees, transaction fees and any additional fees for every individual exchange. Then, do your own calculations to determine which exchange actually has the lowest fees.

The trouble is that decentralized exchanges are much less user friendly, not only from an interface standpoint but also in terms of currency conversion. Decentralized exchanges, for instance, don’t always allow users to deposit dollars and exchange them for crypto. This means you either have to already own crypto or use a centralized exchange to get crypto that you then use on a DEX.

This exchange offers two trading platforms: Kraken and Kraken Pro. The basic Kraken platform with “Instant Buy” doesn’t offer the cheapest fees, although advanced users can get volume discounts and lower their costs by trading on Kraken Pro.

Just like when working with different brokers for trading stocks, fees can vary from crypto exchange to crypto exchange. If you want to find the exchange with the lowest fees overall, you’ll want to research trading fees, transaction fees and any additional fees for every individual exchange. Then, do your own calculations to determine which exchange actually has the lowest fees.